The Of Maryland Wage Garnishment Form

Wiki Article

Rumored Buzz on Stop Wage Garnishment Maryland

Table of ContentsNot known Incorrect Statements About How To Stop A Writ Of Garnishment The 10-Second Trick For Maryland Garnishment LawsThings about Maryland Wage Garnishment ExemptionsAbout Stop Wage Garnishment MarylandIndicators on Maryland Wage Garnishment Exemptions You Should Know

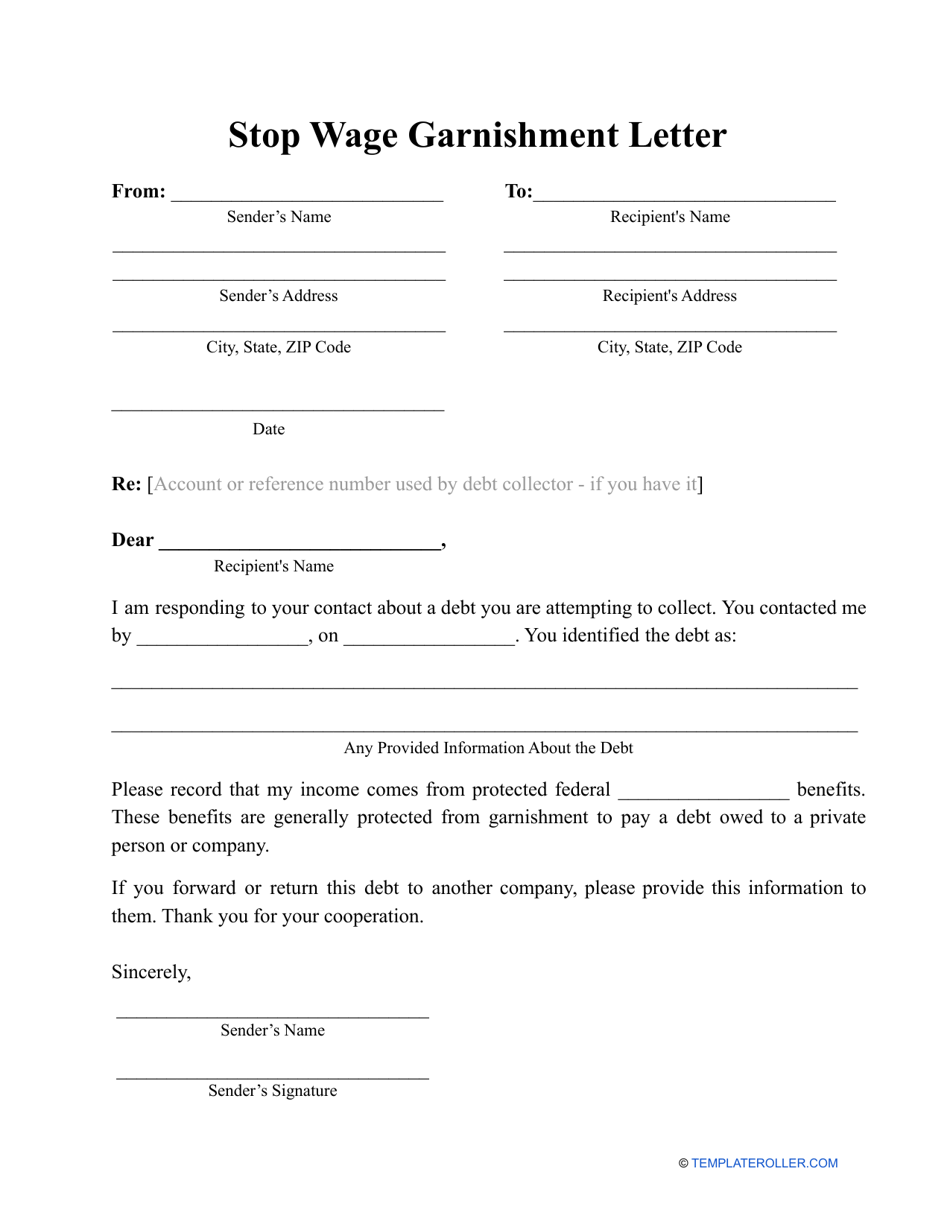

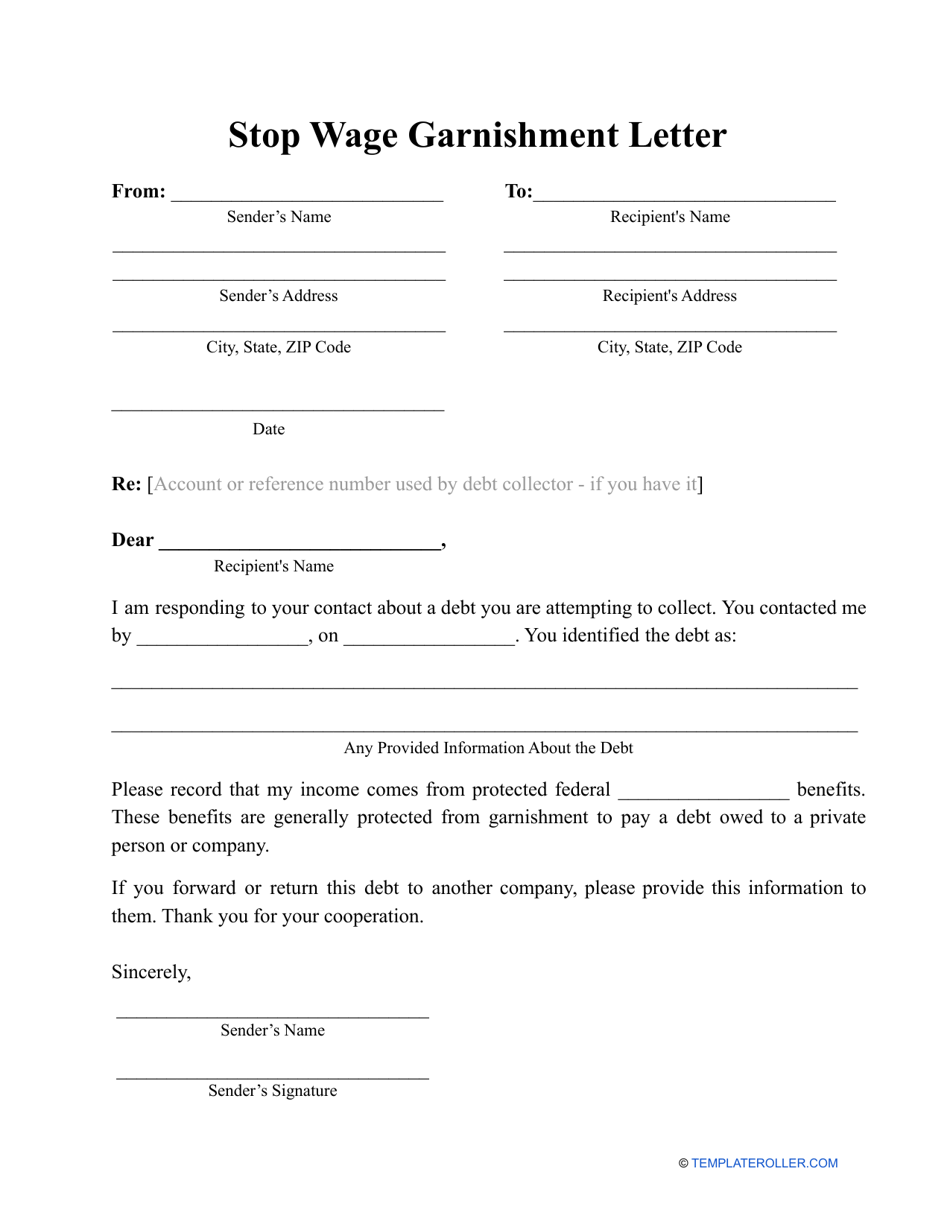

Wage garnishment is a typical problem for millions of Americans. It can be deflating to have your salaries garnished. However you do have choices to protect on your own. Having your earnings garnished can be overwhelming as well as scary. There are some points you can do to stop a wage garnishment. Allow's start with the fundamentals.Lenders as well as collection agencies can't take cash out of your financial institution account with a wage garnishment order (https://calendly.com/m4ryl4ndwggt/maryland-wage-garnishment?month=2022-07). State law as well as exemptions identify what tips a creditor has to take to seek various other collection initiatives as well as exemptions restrict exactly how much they can take.

The financial institution has a court order that says they obtain a particular amount of cash from your earnings every pay duration. If your regular monthly earnings and also living expenditures do not enable you to provide a settlement plan that pays a minimum of as long as what they're making it through the garnishment order, the financial institution is not most likely to concur to it.

If you're dealing with greater than one debt and also have several creditors submitting suits versus you, you may require a totally clean slate. Because case, take into consideration the benefits and drawbacks of Phase 7 insolvency. If it makes good sense for you to file personal bankruptcy, recognize that the wage garnishment needs to stop as soon as your instance has been submitted.

Our Maryland Wage Garnishment Exemptions PDFs

One of these exceptions is wage garnishment for child assistance as well as spousal support. Garnishment orders for this kind of financial debt survive the bankruptcy filing. If you can, avoid having a default judgment gotten in against you. That's the most effective method to get a long time and also potentially negotiate a settlement plan with the creditor.They're in the vehicle driver's seat, and also if they don't enable you to quit a garnishment by concurring to make volunteer payments, you can't actually compel them to.

Of program, when you learn that your creditors have actually won a garnishment order against you, you constantly have the choice of quitting your work. Unless you have a significant quantity of cash in your checking account or access to non-garnishable income like Social Safety and security, alimony, or youngster assistance, this option likely would be ill advised (maryland wage garnishment).

The court may choose that this financial debt does not belong to you which you have no legal responsibility to repay it. You may be able to get away the garnishment order completely by applying for insolvency. Personal bankruptcy safeguards your earnings while the case is pending in court, protecting against creditors from collecting on the financial obligation owed to them.

Top Guidelines Of Maryland Wage Garnishment Form

You can prevent this action by your creditors by making use of among these legal alternatives (maryland wage garnishment calculator) (https://www.awwwards.com/m4ryl4ndwggt/favorites).The following is presented for informative purposes just as well as is not planned as lawful advice. If you have actually fallen behind on expense payments, your company might begin taking money directly out of your income and sending it off to settle your creditors or debt collector. Possibilities are, if you lag on your costs your funds are already stressed.

Nevertheless, you still have rights and may have the ability to locate a way to decrease or stop the garnishment. Creditors typically will not garnish your salaries as a very first step if you fall back on a settlement. But if other collection initiatives have actually failed, or your financial debt is coming close to the statute of restrictions (the end of the duration when financial obligation collection is enforceable), wage garnishment can be the lender's ideal choice.

If the price does not cover what you owe, the creditor could after that attempt to garnish your salaries till you've paid the continuing to be debt. Prior to they can garnish your salaries, many creditors will certainly need to sue you as well as get a judgment from the court. The judgment will claim just how much money you owe, which might consist of the initial debt plus passion and fees.

The Facts About Maryland Wage Garnishment Revealed

Overdue trainee loans, back taxes, spousal support, or youngster assistance can lead to management wage garnishment (AWG), which can be enforced without a court order. You may be able to maintain your incomes from being garnished or reduce exactly how much is secured in numerous ways. As a fast apart, prior to you begin on your own, you can speak with a lawyer who has a better understanding of the legislations as well as customer rights.One of the very first steps you can take is to try as well as work with the lender that desires to garnish your salaries. You may be able to negotiate a smaller sized regular monthly repayment than the quantity that would be taken out of your paycheck.

As an example, many states offer a head of family exception for borrowers that have a dependent, such as a youngster or elderly moms and dad, that they economically sustain. You might be able to challenge the wage garnishment on various premises, such as when even more than the appropriate amount of cash is being obtained of your incomes or if the creditor didn't adhere to the proper process.

An Unbiased View of Maryland Wage Garnishment Form

Report this wiki page